- Eni sells nearly half of Eni CCUS Holding to Global Infrastructure Partners (GIP), part of BlackRock, creating a co-controlled platform for large-scale CCUS projects.

- The deal covers flagship projects in the UK and Netherlands, with future expansion into Italy’s Ravenna CCS and other potential sites.

- Partnership combines GIP’s infrastructure investment expertise with Eni’s technical capabilities to accelerate deployment of decarbonization solutions.

Eni has signed an agreement to sell a 49.99% stake in its carbon capture, utilization and storage subsidiary, Eni CCUS Holding, to Global Infrastructure Partners (GIP), the infrastructure arm of BlackRock. The transaction gives GIP joint control of the business alongside Eni, pending regulatory approvals.

Eni CCUS Holding was established to consolidate and scale Eni’s portfolio of carbon capture and storage projects. The company currently manages the Liverpool Bay and Bacton projects in the UK and the L10 project in the Netherlands. It also holds rights to acquire Eni’s 50% stake in the Ravenna CCS development in Italy, with scope to expand further in the medium to long term.

Eni CEO Claudio Descalzi said: “The decision to consolidate our CCUS global portfolio into a dedicated entity, and the entry of GIP as a strategic partner, will further enhance our ability to deliver large-scale, technically advanced decarbonization solutions. The development of our satellite model applied to our businesses related to the energy transition is therefore successfully continuing, confirming their significant attractiveness in terms of growth potential and value creation by attracting aligned capital, as well as their effectiveness in reducing emissions.”

RELATED ARTICLE: BlackRock Acquires World Leading Infrastructure Investment Platform Global Infrastructure Partners (GIP) for $12.5 Billion

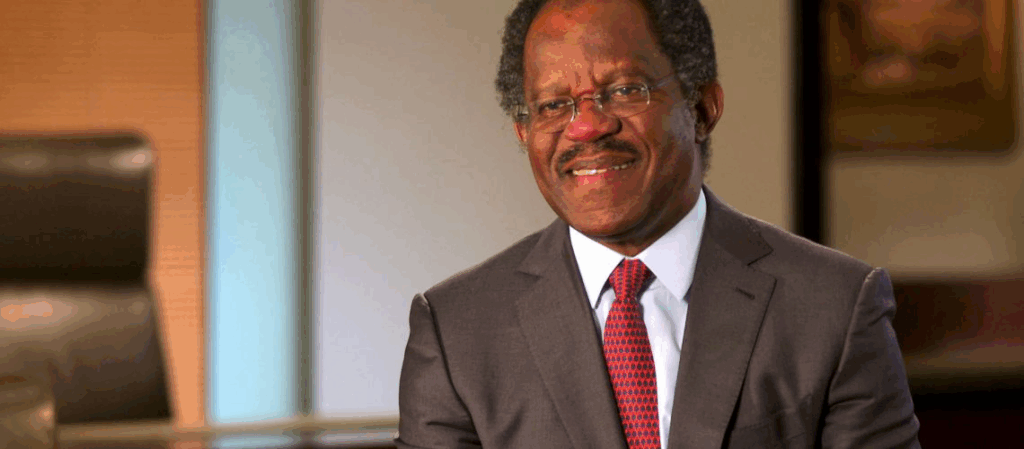

GIP Chairman and CEO Bayo Ogunlesi highlighted the role of the partnership in scaling up solutions for hard-to-abate sectors. “We are excited to partner with Eni, a global leader in CCUS. GIP’s experience in midstream infrastructure, combined with Eni’s technical, operational and industrial capabilities, will help accelerate the deployment of CCUS solutions at meaningful scale, furthering our commitment to serve growing market needs for affordable, decarbonized energy and products.”

CCUS technology, which captures and stores carbon dioxide from industrial processes, is seen as critical to meeting net-zero goals. While advocates emphasize its maturity and scalability, some critics continue to question its cost-effectiveness and potential to prolong fossil fuel use.

Follow ESG News on LinkedIn

The post BlackRock’s GIP Buys 49.99% Stake in Eni’s Carbon Capture Business appeared first on ESG News.