ADFW 2025 Announces Speakers and Agenda – Abu Dhabi Finance Week Update

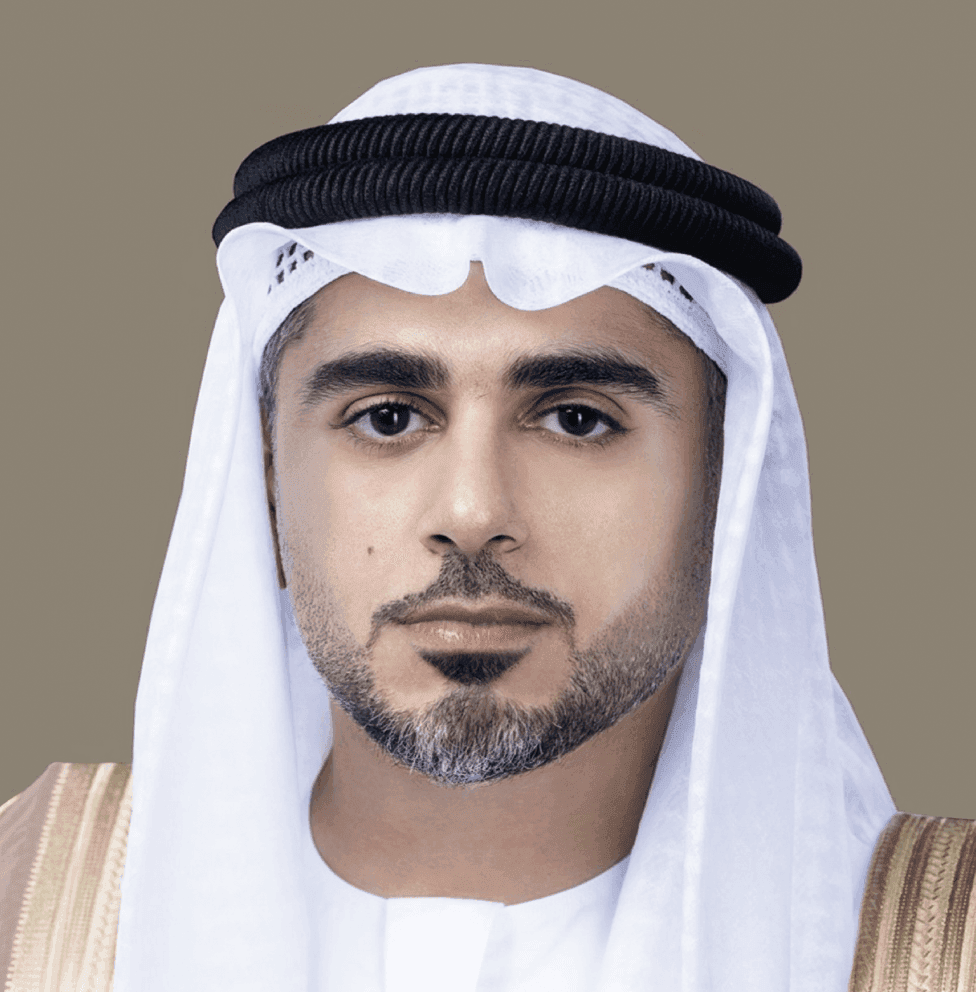

Abu Dhabi Finance Week (ADFW) 2025 is set to host one of the most influential gatherings in global finance, bringing together CEOs, founders, policymakers, and investors who collectively manage more than USD 62 trillion in assets—over 50% of global GDP.The event takes place 8–11 December 2025 in Abu Dhabi under the patronage of His Highness Sheikh Khaled bin Mohamed bin […]

Edison to Build 500 MW New Renewable Capacity in 2026 with $647M+ Investment

Edison will open construction on more than 500 MW of new wind and solar capacity in 2026, on top of 250 MW already in progress. Investment exceeds EUR 600 million (about USD 647 million), backed by EIB financing of up to EUR 800 million (USD 863 million). Projects tie directly to Italy’s 2030 climate objectives […]

Bank of England Sets Tougher Climate Risk Rules for Banks and Insurers

• BoE finalises strengthened climate risk expectations for banks and insurers, replacing 2019 rules.• New policy requires stronger board accountability, better scenario use, and improved data quality.• Firms must review compliance and produce action plans, with supervisors expecting evidence after six months. The Bank of England has issued its most stringent climate risk policy to […]

Microsoft Backs Pantheon to Expand Peatland Restoration, High Integrity Carbon Removal

• Microsoft’s Climate Innovation Fund invests in Pantheon Regeneration to scale U.S. peatland restoration and carbon removal.• Pantheon’s Pocosin Ecological Reserve I stands among the first commercial peatland restoration projects in the U.S., designed to generate high-volume, high-integrity carbon credits with biodiversity and water impacts.• The partnership advances nature-based removals aligned with global net-zero pathways, […]

EU Advances Simplified Sustainability Reporting as EFRAG Submits Revised ESRS to Commission

• Mandatory datapoints shrink by 57–68% as Europe aims to relieve compliance pressure without weakening Green Deal ambition• Materiality assessments overhauled, voluntary disclosures removed entirely, and value-chain estimates permitted to limit costly data-gathering requirements• Next step: European Commission to draft Delegated Act, with consultation open until September 2025 and full adoption targeted end-2025 Europe moves […]