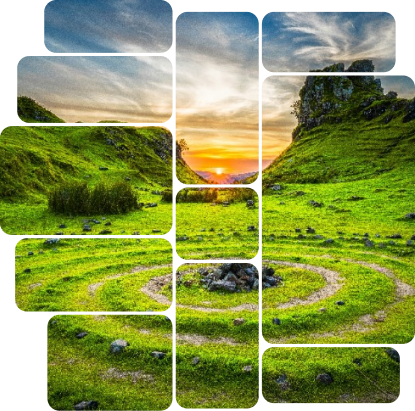

Let's Conserve & Preserve Nature

We aim to enable everyone, everywhere to preserve and rejuvenate nature, thus ensuring worldwide prosperity. True change requires collective effort—from companies, projects, investors, to individuals like you—to fully unlock nature’s potential.

Our Technology & Vision

Our online platform simplifies the process of conserving and restoring nature by allowing people everywhere to invest in Nature-based Solutions. We choose projects based on scientific guidance and select companies with credible emissions reduction plans to avoid greenwashing. This approach guarantees that transparency, integrity, and impact are consistently prioritized.

Drawing on deep Fintech and blockchain financial market experience, we bring best in class technology and infrastructure to bear to help improve and restore our shared environment.

Our Value Proposition

Quality & Transparency

ESGCX is committed to offering only premium carbon credit projects. Each project is rigorously rated and reviewed for quality by independent third-party agencies, ensuring transparency and integrity in our selections for a sustainable future.

Deep Liquidity

ESGCX prides itself on deep-rooted industry relationships and strategic partnerships that ensure robust liquidity, providing a dependable funding stream for issuers to bring their environmental projects to life. Our extensive network amplifies project reach and funding potential, solidifying our role as a pivotal junction between ambitious sustainability projects and committed investors.

Flexibility

ESGCX offers unparalleled flexibility in participating in carbon markets. Tailored to your preferences and needs, you can choose to purchase shares for long-term investment, credits for immediate offset needs, or forwards for future emission reductions. Our platform facilitates a seamless transaction process, allowing you to invest in the health of our planet your way.

Partners

Our Team

FAQs

What questions our customers frequently asked

How are carbon credits created and used?

Carbon credits are financing tools to support projects that reduce greenhouse gas emissions or recapture carbon from the atmosphere. They represent the reduction or removal of one metric ton of carbon dioxide equivalent gases and can be used by companies to offset their emissions as part of their sustainability goals.

What's the difference between regulated and voluntary carbon credits?

Regulated carbon credits are strictly governed by government policies, while voluntary credits are created through private initiatives and are often purchased by entities seeking to offset their emissions beyond regulatory requirements.

How is the integrity of carbon credits maintained?

Carbon credits’ integrity is assured by adherence to standard criteria and validated methodologies from recognized carbon standard organizations. They undergo third-party verification to prevent greenwashing and ensure that they represent real emissions reductions.

Can individuals and small companies purchase carbon credits?

Yes, individuals and small companies can invest in carbon credits to offset their carbon footprint. Platforms often provide various options suitable for different scales of investment.

What happens after purchasing carbon credits?

Upon purchasing, carbon credits are typically “retired” on behalf of the buyer, ensuring that the credits can’t be resold, and buyers may receive certificates indicating the retirement of these credits for their emissions offset.

Are there carbon credit projects that focus on biodiversity or community development?

Many carbon credit projects, especially those in forest conservation and restoration, not only focus on carbon capture but also contribute to biodiversity and provide benefits to local communities.